san francisco gross receipts tax instructions

Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. Beginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax.

Secured Property Taxes Treasurer Tax Collector

Annual Business Tax Return Instructions 2021 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

. 0370 percent for gross receipts between 2500001. SAN FRANCISCO RESIDENTIAL RENT ASSISTANCE PROGRAM FOR PERSONS DISQUALIFIED FROM FEDERAL RENT SUBSIDY PROGRAMS BY THE FEDERAL QUALITY HOUSING AND WORK RESPONSIBILITY ACT OF 1998 QHWRA. As noted in section 40116b of title 49 of the United States Code Section 40016b the Gross Receipts Tax in Article 12-A-1 of the San Francisco Business and Tax Regulations Code shall not apply to the gross receipts from that air commerce or transportation as that phrase is used in Section 40016b.

Ad Find out what excise tax applies to and how to manage compliance with Avalara. For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate. Line 2 Receipts Subject to the Commercial Rents Tax.

City and County of San Francisco 2000-2020. Gross Receipts Tax Applicable to Private Education and Health Services. Administrative and Support Services.

The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for filing the Return. Payroll Expense Tax Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. Line 1 San Francisco Gross Receipts.

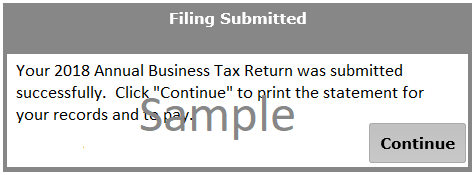

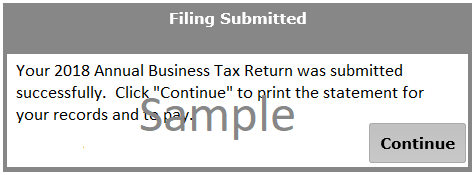

San francisco gross receipts tax instructions. 2020 Annual Business Tax Returns. Annual Business Tax Return Instructions 2018 The San Francisco Annual Business Tax Online Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office Tax.

Gross Receipts rates vary depending on a businesss gross receipts and business activity. Persons and combined groups with more than 50000000 in combined taxable San Francisco gross receipts are required to file and pay the Homelessness Gross Receipts Tax. 1 The existing payroll expense tax is being phased out in increments consistent with the phase-in of the gross receipts tax over a.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross Receipts Tax. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of. However the gross receipts of an airline or other person engaged in the.

16 rows Enter your 2021 Taxable San Francisco Gross Receipts enter whole numbers only. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes.

Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense. Greater than 3001 a 03 overpaid executive tax rate. Annual Business Tax Return Instructions 2020 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

E The amount of gross receipts from retail trade activities and from wholesale trade activities subject to the gross receipts tax shall be one-half of the amount determined under Section 9561 plus one-half of the amount determined under Section 9562. Learn about excise tax and how Avalara can help you manage it across multiple states. Estimated SF Gross Receipts The estimated amount of San Francisco gross receipts expected during the current calendar year.

Taxpayers deriving gross receipts from business activities both within and outside San Francisco must generally allocate andor apportion gross receipts to San Francisco using rules set forth in Business and Tax Regulations Code Sections 9561 and 9562. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. The San Francisco Business.

This number will be pulled from the Gross Receipts Tax filing. Greater than 3001 a 03 overpaid executive tax rate. The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for filing the Return.

The HUDOC database provides access to the case-law of the Court Grand Chamber Chamber and Committee judgments and decisions communicated cases advisory opinions and legal summaries from the Case-Law Information Note the European Commission of Human Rights decisions and reports and the. In the 1970s the City added the payroll expense tax and allowed businesses to pay either the payroll tax or the gross receipts tax the so-called alternative method the constitutionality of which the City was later challenged for in court in 1999. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio.

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Gross Receipts Tax And Payroll Expense Tax Sfgov

Overpaid Executive Gross Receipts Tax Approved Jones Day

Joint Venture Agreement Templates Agreement Sample Templates Construction Joint Venture Agre Proposal Templates Joint Venture Agreement

Secured Property Taxes Treasurer Tax Collector

Ca San Francisco Proposition C Increases Gross Receipts Tax On Lessors Of Commercial Real Estate

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

San Francisco Tax Attorney And Cpa David Klasing

Renters Lease Agreement Real Estate Forms Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

Key Dates Deadlines Sf Business Portal

2020 Gross Receipts Tax Return Youtube

Treasurer Jose Cisneros Facebook

Commercial Vacancy Tax Vt Treasurer Tax Collector

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

Homelessness Gross Receipts Tax

Homelessness Gross Receipts Tax

Property Tax Search Taxsys San Francisco Treasurer Tax Collector